June 26, 2025

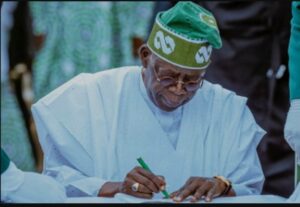

President Bola Tinubu, has signed four landmark tax reform bills into law, the tax reform is said to have been designed to overhaul Nigeria’s fiscal and revenue administration framework, a move seen as a major leap in the nation’s economic reform drive.

The four newly enacted laws, were the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill, were passed by the National Assembly after extensive consultations with a broad spectrum of stakeholders and interest groups nationwide

The signing ceremony, at the Presidential Villa on Thursday in Abuja, was witnessed by top government officials including the President of the Senate, the Speaker of the House of Representatives, the Senate and House Majority Leaders, as well as chairmen of the Senate and House Committees on Finance.

READ MORE;Tinubu Moves to Settle N2tn Power Sector Debt, Restore Electricity Supply Confidence

Others in attendance were the Chairman of the Nigeria Governors’ Forum, the Chairman of the Progressive Governors’ Forum, the Minister of Finance and Coordinating Minister of the Economy, and the Attorney General of the Federation.

President Tinubu said the bills reflected his administration’s commitment to creating a modern, transparent, and efficient tax system capable of supporting national development, promoting investment, and reducing the burden of multiple taxation.

The Nigeria Tax Bill (Ease of Doing Business) consolidates Nigeria’s fragmented tax statutes into a unified legal framework. It seeks to reduce tax duplication, enhance clarity, and ease compliance for taxpayers.

The Nigeria Tax Administration Bill provides a harmonized legal and operational structure for tax administration at the federal, state, and local government levels, aiming to foster efficiency and uniformity in tax collection.

READ MORE; Tinubu Approves Licences for Northern Oil Project, Boosting Exploration in Kolmani

The Nigeria Revenue Service (Establishment) Bill repeals the existing Federal Inland Revenue Service (FIRS) Act, paving the way for the establishment of a new, performance-driven Nigeria Revenue Service (NRS) with expanded responsibilities, including non-tax revenue collection. The bill also introduces strong mechanisms for accountability and transparency.

The Joint Revenue Board (Establishment) Bill sets up a national governance structure to coordinate tax efforts across all tiers of government.

Further more, It also introduces a Tax Appeal Tribunal and an Office of the Tax Ombudsman, enhancing taxpayer rights and dispute resolution mechanisms.

The reforms are expected to bring about job creation, improve public service delivery, and build public confidence in the nation and it tax system.